Income Tax Challan - How to Pay Your Income Tax Online?

⚠IMPORTANT

Income tax payment facility has been migrated from OLTAS to ‘e-Pay Tax’ facility on the e-filing portal. As a result, Challan 280 is no longer necessary or applicable. Please refer to the detailed guide below on how to make your tax payment on the income tax portal.

How to e-Pay Tax online?

Here’s a step-by-step guide on how to make tax payment on the Income Tax Portal without logging in:

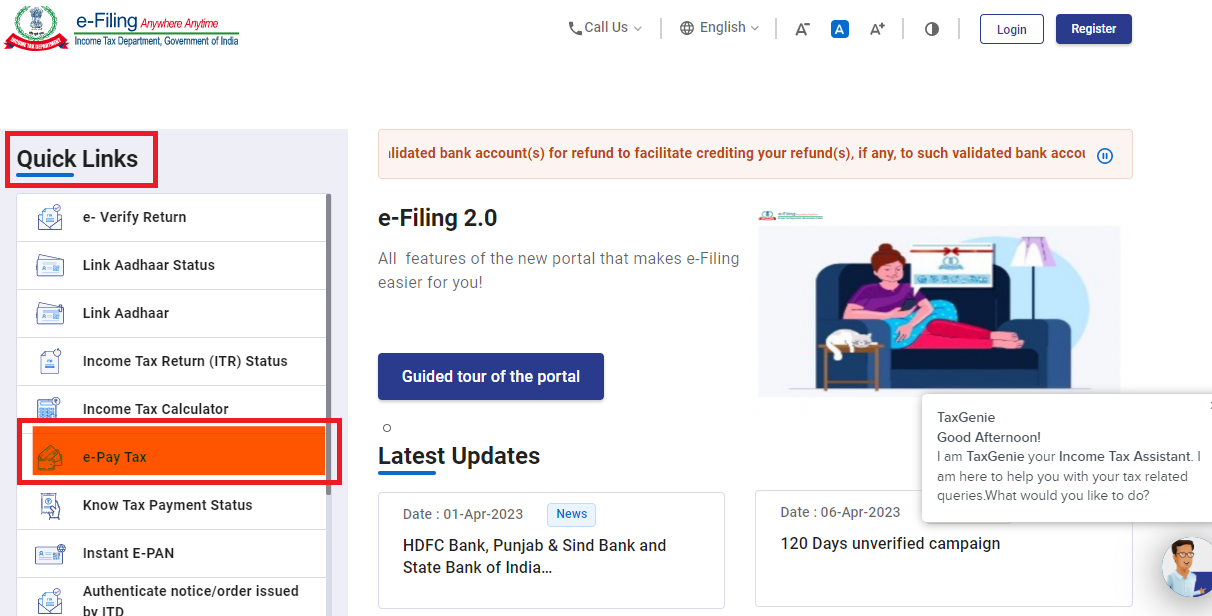

Step 1: Navigating to ‘e-Pay Tax’ Section

- Visit the Income Tax Portal

- On the homepage, locate the ‘Quick Links’ section on the left side.

- Click on the ‘e-Pay Tax’ option or use the search bar to find ‘e-Pay Tax’.

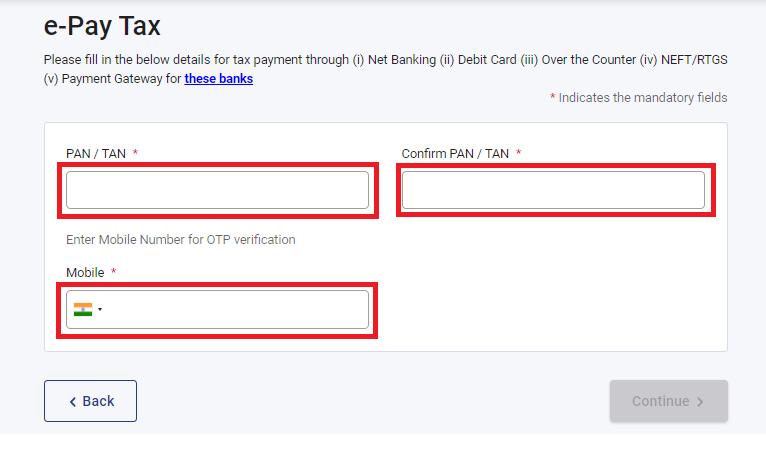

Step 2: Enter PAN/TAN and Mobile Number

- Enter your PAN and re-enter to confirm it.

- Provide your mobile number and click ‘Continue’.

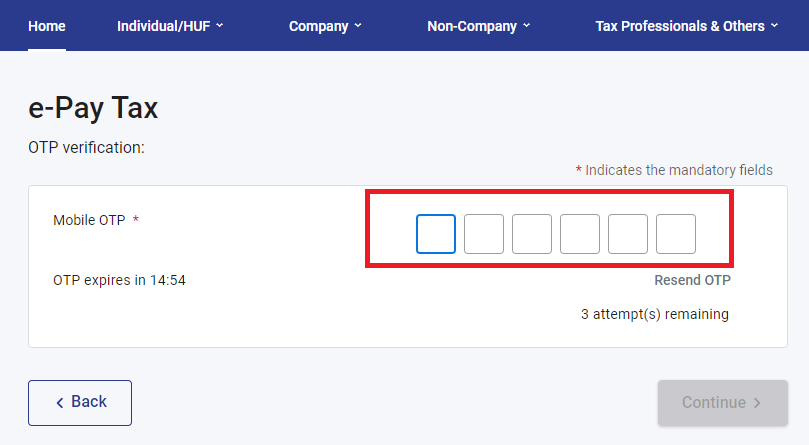

- Enter the 6-digit OTP received on your mobile number and click ‘Continue’.

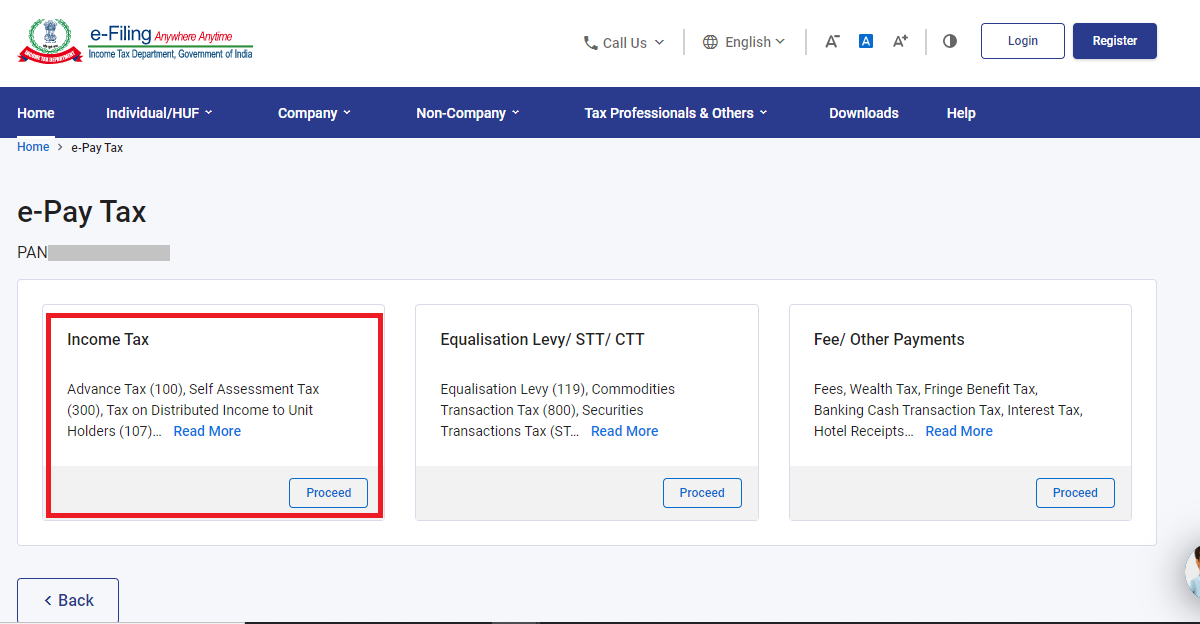

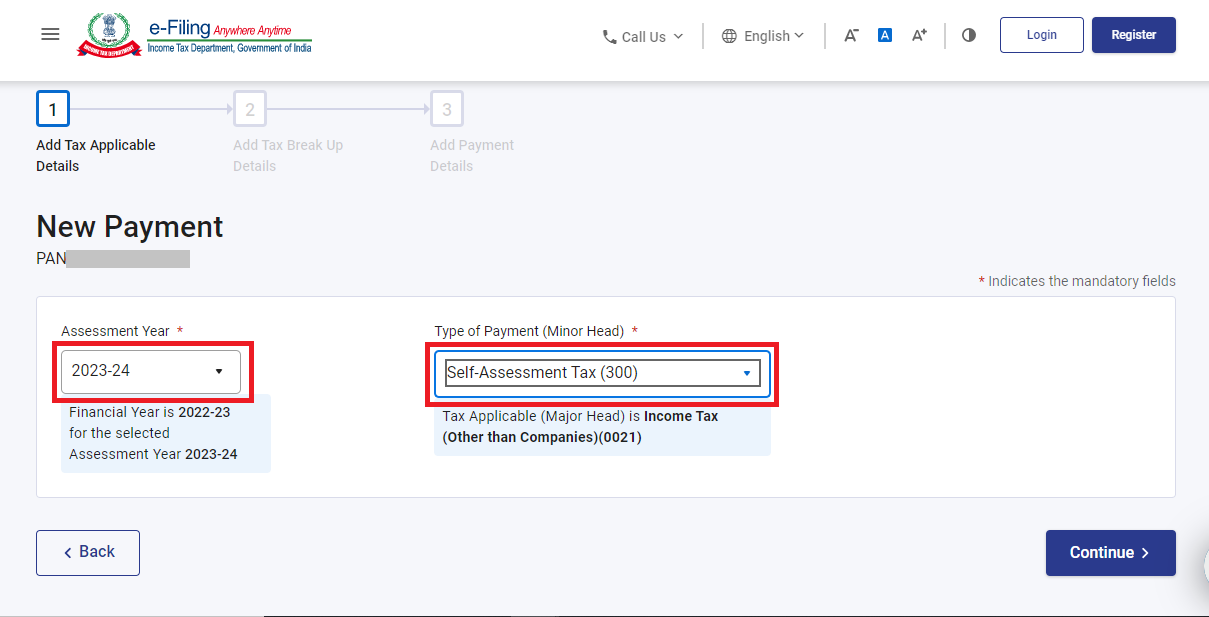

Step 3: Select the correct Assessment Year and Payment Type

- Select the first box labelled as ‘Income Tax’ and click ‘Proceed’

- From the ‘Assessment Year’ dropdown, select ‘2023-24’

- Under the ‘Type of Payment’, select ‘Self-Assessment Tax (300)’ and click on ‘Continue’.

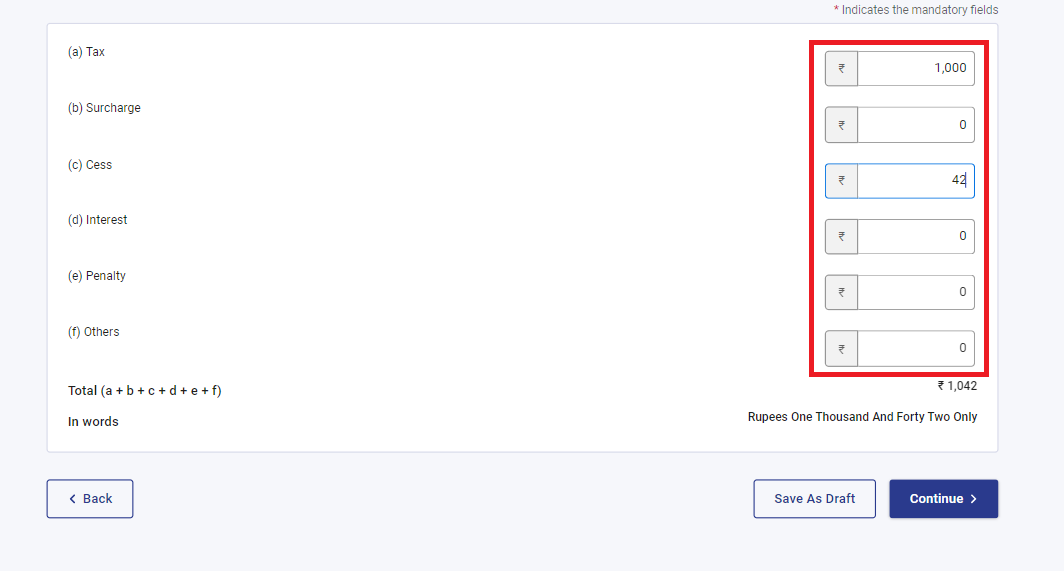

Step 4: Enter Tax Payment Details

– Enter the payment amounts accurately under the relevant categories.

– You can refer to the pre-filled challan on Taxgaadi for the necessary amounts.

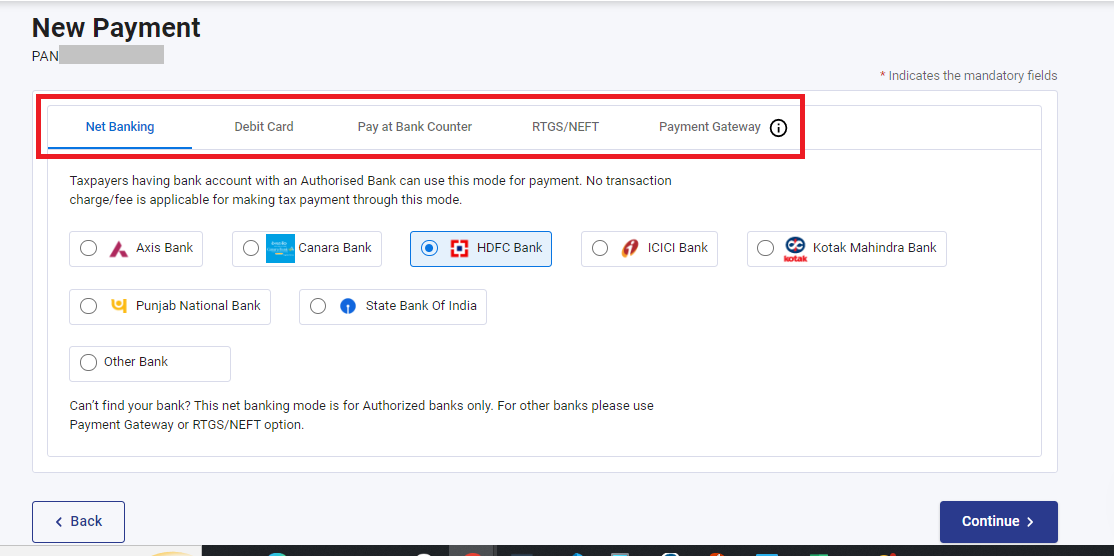

Step 5: Select the Payment Method

- Select the payment method and bank to make the tax payment and press ‘Continue’.

- Payment can be made using internet banking, debit card, credit card, RTGS/NEFT, UPI or you can choose to pay at the bank counter.

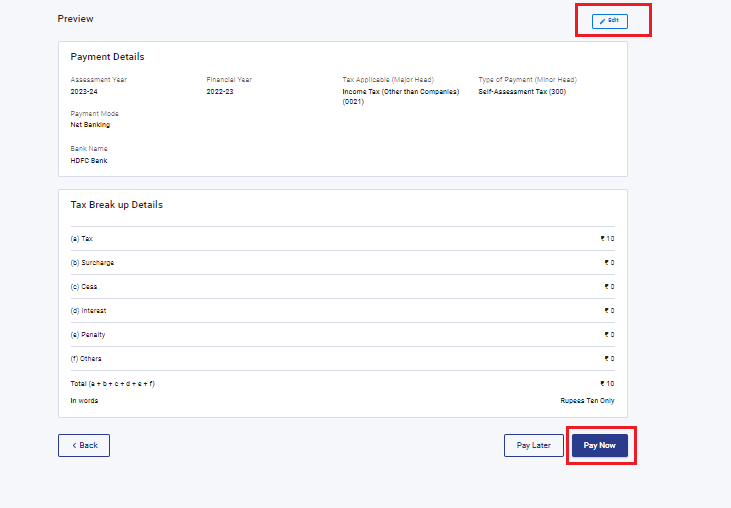

Step 6: Verify Payment Information

- After clicking ‘Continue’, you can preview the challan details.

- Double-check the payment information for accuracy.

- Click ‘Pay Now’ to make the payment or ‘Edit’ to modify the details.

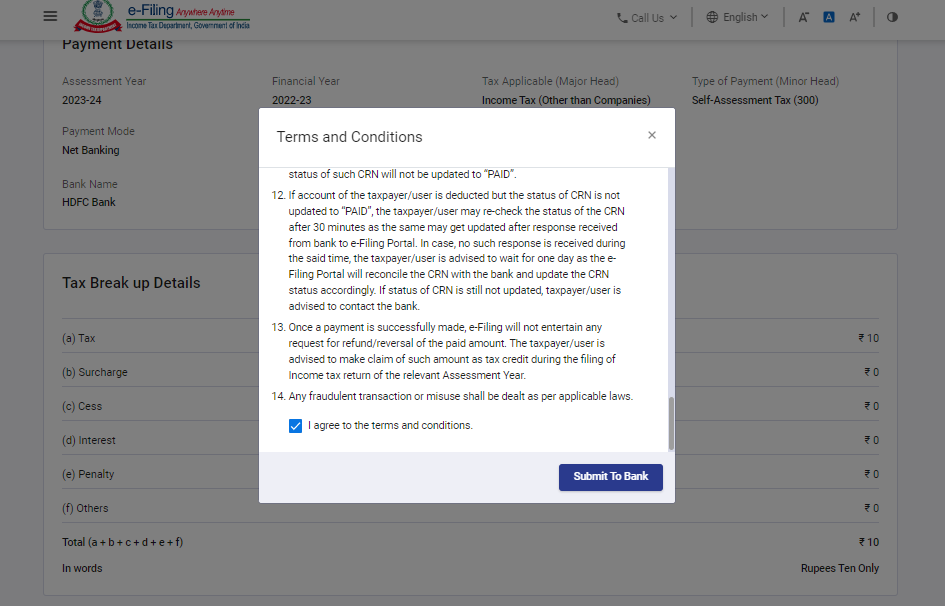

Step 7: Submit the Payment

- Tick the checkbox to agree to the Terms and Conditions.

- Click ‘Submit To Bank’ to proceed with the payment.

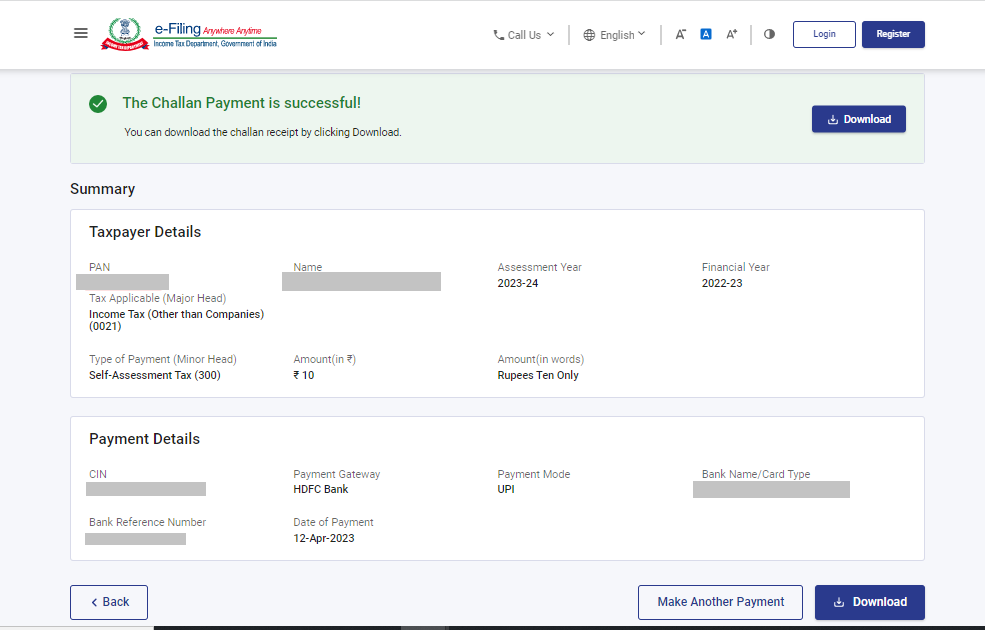

Step 8: Receive Payment Confirmation

- You will receive a confirmation once your tax payment has been successfully submitted.

Note: Remember to download the challan as you will need the BSR code and Challan number for completing the return filing process.

Step 9: Declaring Tax Paid Details

- After making the tax payment, update the payment information on Taxgaadi.

- Go to the ‘Tax Summary’ page and click ‘Add Paid Tax Details’.

- Upload the challan or enter the details manually.

- Once done, your tax payment status will change to ‘taxes paid’.

- Proceed to e-file and e-verify your return on Taxgaadi

You may refer to this guide for further steps.

Banks Authorised for e-Tax Payment

Here’s an updated list of banks that can be found on the e-filing portal for e-payment of taxes w.e.f 28.04.2023:

- Axis Bank

- Bank of Baroda

- Bank of India

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- City Union Bank

- Federal Bank

- HDFC Bank

- ICICI Bank

- IDBI Bank

- Indian Bank

- Indian Overseas Bank

- IndusInd Bank

- Jammu and Kashmir Bank

- Karur Vysya Bank

- Kotak Mahindra Bank

- Punjab National Bank

- Punjab & Sind Bank

- RBL Bank

- State Bank of India

- UCO BANK

- Union Bank of India

Benefits of e-Tax Payment

The provision of being able to pay taxes electronically has definitely made paying taxes a lot easier. Some of the benefits of e-Payments are as follows:

- Saves time and can be done at one’s convenient time, avoiding long queues

- Tax department records are updated automatically without the taxpayer having to take additional measures to ensure the updating of records

- Instant generation of the receipt of tax payment

- Verifying the status of tax payment can be done online

Eligibility for e-Tax Payment

With effect from 1st April, 2008 the following assessees have to mandatorily pay taxes online.

- All the corporate assesses.

- All assesses (other than company) to who the provisions of section 44AB of the Income Tax Act, 1961 are applicable.

Self-Assessment Tax

You cannot submit your income tax return to the income tax department unless you have paid tax dues in full. Sometimes, you may see tax payable at the time of filing your return. This tax is called Self Assessment Tax, which you can pay online to ensure successful e-filing.

You should also pay the interest under sections 234B and 234C along with your tax due, if you are paying tax after 31 March. When you e-file with Taxgaadi, our system will automatically tell you how much tax you need to pay to file your return. You can also get your return verified by a CA to make sure that you paid the correct amount.

Disclaimer:-

“All the information given is from credible and authentic resources and has been published after moderation. Any change in detail or information other than fact must be considered a human error. The blog we write is to provide updated information. You can raise any query on matters related to blog content. Also, note that we don’t provide any type of consultancy so we are sorry for being unable to reply to consultancy queries. Also, we do mention that our replies are solely on a practical basis and we advise you to cross verify with professional authorities for a fact check.”